Renters Insurance in and around Sunnyside

Renters of Sunnyside, State Farm can cover you

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Sunnyside

- Grandview

- Mabton

- Outlook

- Prosser

- Granger

- Yakima Valley

- Zillah

- Toppenish

- Lower Yakima Valley

- Oregon

Home Sweet Home Starts With State Farm

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented townhouse or condo, renters insurance can be the most sensible step to protect your possessions, including your desk, fishing rods, children's toys, clothing, and more.

Renters of Sunnyside, State Farm can cover you

Coverage for what's yours, in your rented home

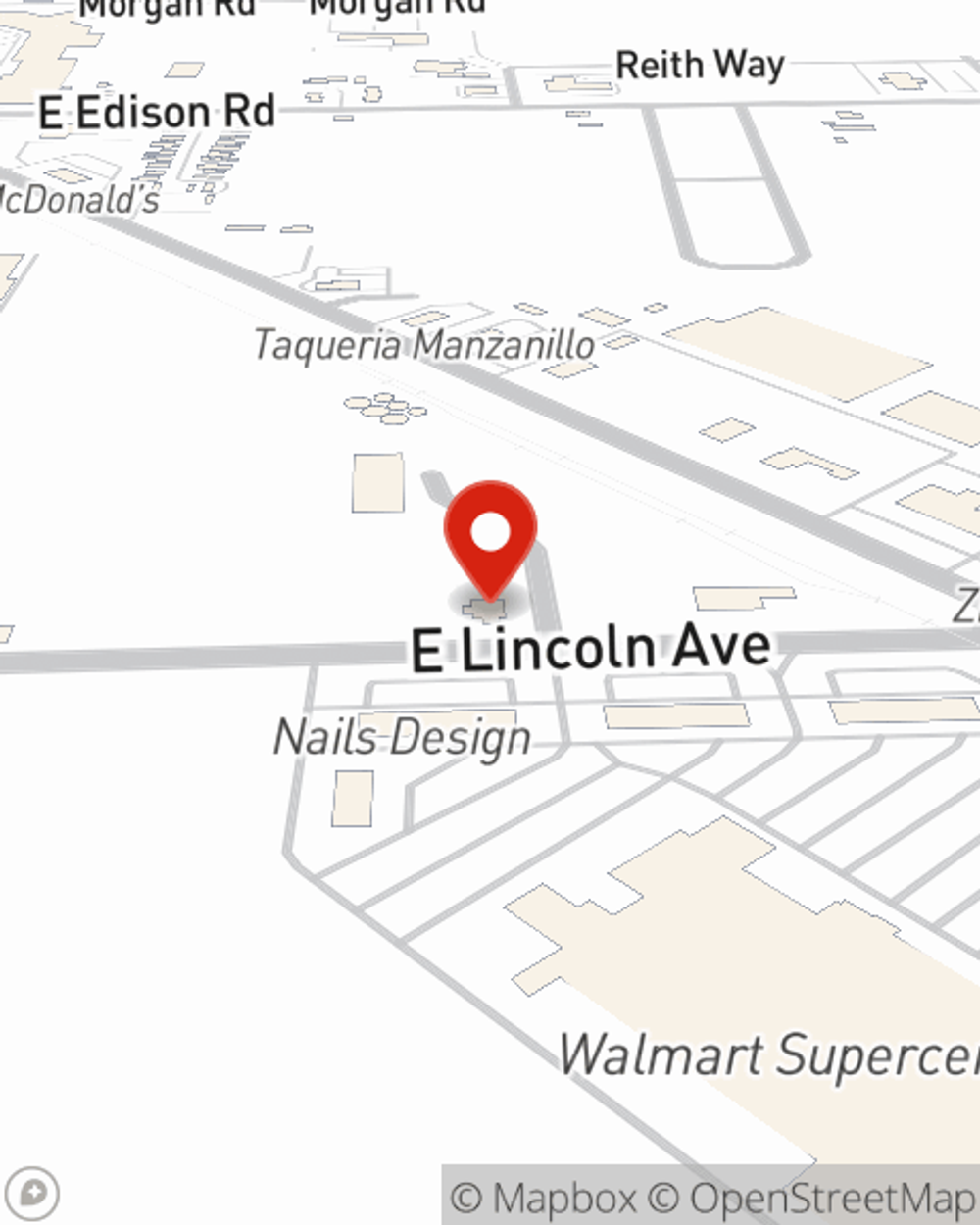

Agent Bryan Robison, At Your Service

When renting makes the most sense for you, State Farm can help shield what you do own. State Farm agent Bryan Robison can help you generate a plan for when the unanticipated, like a fire or an accident, affects your personal belongings.

There's no better time than the present! Reach out to Bryan Robison's office today to learn how you can protect your belongings with renters insurance.

Have More Questions About Renters Insurance?

Call Bryan at (509) 837-4670 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Bryan Robison

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.